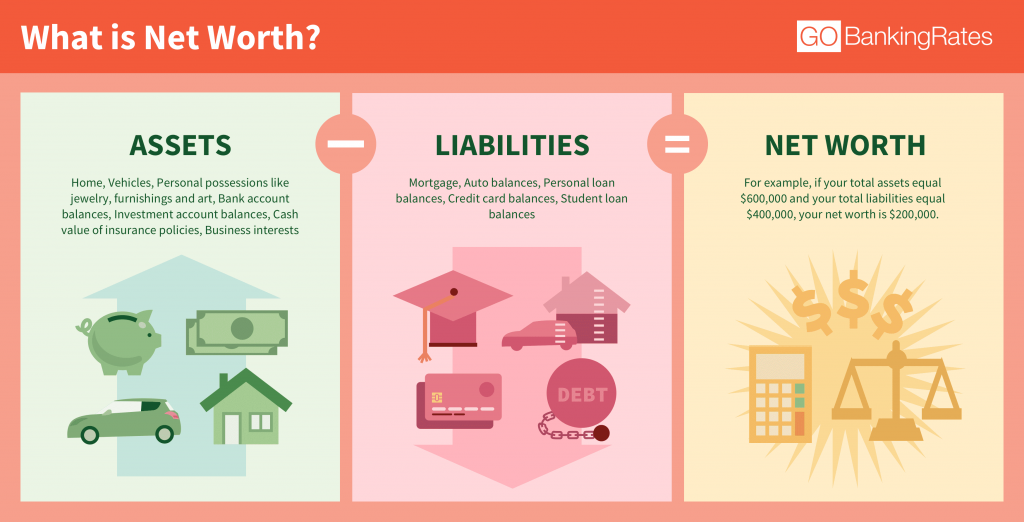

Automobiles and other assets valued at $25,000 liabilities include: Track investments, property values, and debts in real-time with financial dashboards. Their net worth will be negative if the sum of an individual’s credit card bills, utility bills, outstanding mortgage payments, auto loan bills, and student loans is higher than the total value of their cash and investments. Its that simple. Knowing your net worth is critical to understanding your overall financial health and ensuring. Net worth is the difference between assets and liabilities of an individual or business. The balance sheetis also known as a net worth statement. Net worth presents an easy way to measure a person or companys financial standing. See full list on investopedia. com Use this free tool to estimate your net worth by subtracting your liabilities from your assets. · net worth is the sum of your assets minus your liabilities. The value of a company’s equity equals the difference between the value of total assets and total liabilities. An outstanding mortgage balance of $100,000 2. Liabilities include debts like mortgages, credit card balances, student loans, and car loans. Liabilities can also include obligations such as bills and taxes that must be paid. The term “ net worth ” is used in the financial world to qualify certain individuals for particular investment strategies or financial p. Primary residence valued at $250,000 2. A negative net worthresults if total debt is more than total assets. The values on a company’s balance sheet highlight historical costs or book values rather than current market val. How do you calculate your net worth? · whether you’re planning for retirement, applying for a loan, or simply tracking your financial progress, knowing how to calculate net worth is essential. How do you describe your net worth? Robberger. com has been visited by 10k+ users in the past month Learn how to calculate net worth, why it matters, and see examples of positive and negative net worth. An individual’s net worth is the value that’s left after subtracting liabilities from assets. Consider a couple with the following assets: Net worth can be increasedby increasing assets while reducing debts and other liabilities. In this guide, we’ll explain what net worth means, how to calculate it, and provide a step-by-step breakdown using real-world examples. They include loans, accounts payable (ap), and mortgages. An investment portfoliowith a market value of $100,000 3. View upcoming bills · works on smartphones · read articles · track net worth for free Easy to use, connect accounts, track automatically, free apps Why should you calculate your net worth? · net worth is an individual or companys total assets, minus any liabilities or debts. Simply put, your net worth is how much money you have left after you factor in your debts. Net worth is a good way of understanding the true wealth of an individual or business. Calculating your net worth involves adding up all your assets, then all your liabilities, and finding the difference between the two. An asset is anything owned that has monetary value. Looking only at someone’s assets can be misleading because this is often offset by some amount of debt and liabilities. It’s an important metric to gauge a company’s health, providing a useful snapshot of its current financial position. Positive net worth means that assets exceed liabilities. Net worth is calculated by subtracting all liabilities from all assets. Negative net worth is a sign that an individual or famil. A car loan of $10,000 the couple’s net worth would therefore be calculated like this: An individual’s assets can include checking and savings account balances, the. Net worth is the value of assets an individual or corporation owns minus the liabilities they owe. Learn how to use the net worth formula, strategies to increase your net worth, and why it matters for your financial well-being. Net worth can be described as either positive or negative. Learn how to improve your net worth with the 7 baby steps, the retire inspired quotient and smartvestors. Net worth is known as book value or shareholders’ equity in business. Weve compared 8 leading net worth calculators so you can choose the perfect tool for you. When you calculate your net worth ,. Keeping track of. Liabilities are obligations that deplete resources. What is your net worth?